Extreme inequality is no accident

Today, Australia’s 48 billionaires hold more wealth than the bottom 40% of the population combined, almost 11 million people. The existence and rapid growth of billionaires is a sign of an economy where too much wealth and power are concentrated in too few hands. Such an accumulation of wealth shows a system that is failing people, both in Australia and internationally.

Across the globe, billions of people are face avoidable hardships of poverty, hunger and death from preventable diseases because the system is rigged against them. In 2025, global billionaire wealth jumped to $27.7 trillion – its highest level in history. Billionaires are also 4,000 times more likely to hold political office than ordinary citizens.

Meanwhile, in Australia, more than 3.7 million people live in poverty, including 757,000 children. Since 2020, eight new Australian billionaires have been minted. The gap between those doing it toughest and those benefitting most is stark.

Tackle inequality. Together, let’s make tax fair

We all want to live in a society where everyone is able to keep a roof over their head, food on the table and to live with choice, dignity and equal opportunity. At Oxfam, we strive for a fair and equal future without the inequalities that keep people in poverty.

To ensure there is enough money in the federal budget to pay for the services everyone needs, the super-rich need to pay their fair share of taxes and corporations must pay what they owe.

By increasing the Australian Government’s tax revenue, there will be more money available to fund better quality healthcare, education, humanitarian aid and action on climate change as part of a strong social safety net to alleviate poverty at home and abroad.

All lives are equal. Let’s fight for a society without the inequalities that keep people in poverty.

MAKE TAX FAIROur campaigns

Make corporations pay their fair share

Many big corporations are making super profits, often during times of crisis. Its not fair that they rake it in, while the rest of us struggle with the cost of living. Its time they gave more back to the community through a crisis profits tax.

Bill the billionaires. Fight inequality.

A wealth tax on Australia’s richest would generate $32 billion annually. This would help balance the scales on inequality and ensure there is money in the budget for essential services like health and education, and to eradicate poverty.

Make Polluting Corporations Pay

Big energy corporations and billionaires are most responsible for the climate crisis. It’s time to tax rich polluters, end fossil fuel subsidies and use the funds to support communities already experiencing the destructive impacts of climate change.

Read our reports

Resisting the Rule of the Rich

The number of billionaires has surpassed 3,000 for the first time, and the level of billionaire wealth is now higher than at any time in history. This report shows how the economically rich are becoming politically rich the world over, able to shape and influence politics, societies and economies. In sharp contrast, those economically with the least wealth are becoming politically poor, their voices silenced in the face of growing authoritarianism and the suppression of hard-won rights and freedoms.

The Elephant in the Room. Australia’s Failure to Tax Wealth

This report shows the Government failing to tax wealth and giving big tax breaks to high income earners. This includes superannuation, negative gearing, trusts, and importantly, the capital gains tax discount. In 2022-23, 85.6% of the capital gains tax discount went to the top 10% of income earners.

Takers Not Makers: The unjust poverty and unearned wealth of colonialism

Takers Not Makers, reveals an unsettling reality: the world’s billionaires continue to make trillions while billions of people continue to live in poverty. The report underscores how today’s inequalities reflect centuries of colonialism and exploitation, and the continued dominance of the wealthy elite and multinational corporations over low-income countries and people.

Carbon inequality kills

The evidence is clear: the world’s richest people are using a disproportionate amount of the world’s remaining carbon budget and setting us all on course for irreversible and catastrophic global warming.

Cashing in on Crisis

In 2022-2023, top 500 Australian corporations raked in $98 billion in additional windfall profits, or ‘crisis profits’, that they wouldn’t have made under normal circumstances. These profits are part of a wider crisis-fuelled inequality story, where billionaires were able to increase their wealth and boost their bank balances while the rest of us endured rising costs of living.

Inequality Inc

The wealth of the three richest Australians, Gina Rinehart, Andrew Forrest and Harry Triguboff, has more than doubled since 2020 at a staggering rate of $1.5 million per hour, while 5 billion people find themselves poorer. These are some of the stark findings of Inequality Inc, an Oxfam flagship report launched ahead the 2024 annual meeting of the World Economic Forum.

Climate Equality: A Planet for the 99%

The richest 1% emit as much carbon pollution as two-thirds of humanity. This is just one of the shocking findings of Oxfam’s landmark ‘Climate Equality: A Planet for the 99%’ report released ahead of the annual United Nations international climate change conference COP28.

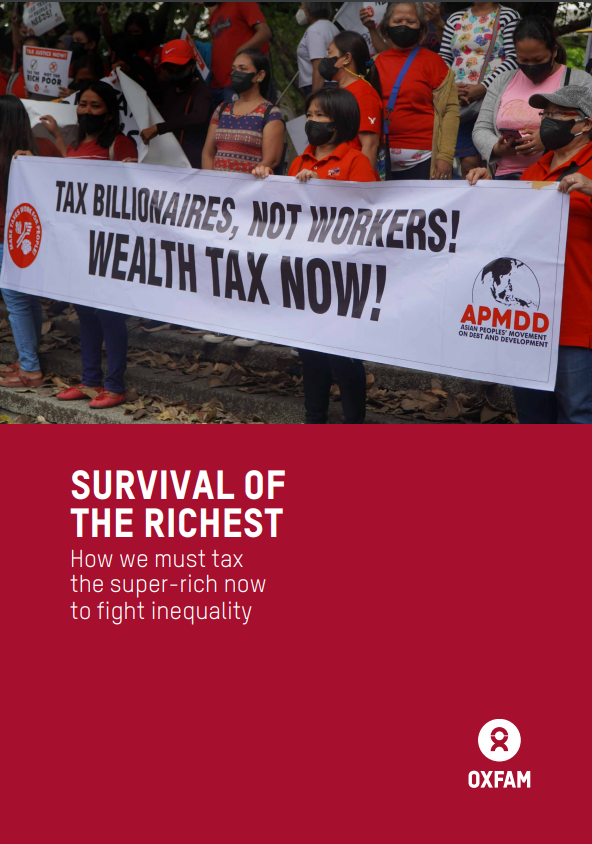

Survival of the Richest

Oxfam revealed that the richest 1% of Australians accumulated 10 times more wealth than the bottom 50% in the past decade, as cost-of-living pressures bite and global inequality spikes.

In the News

24,000 millionaires pocket half of capital gains tax break: Oxfam Australia

Nearly 50% of the capital gains tax discount went to just 24,000 people who earned over $1 million in 2022–23, according to Oxfam Australia report released in October. Oxfam is calling on the Australian government to end unfair tax discounts that overwhelmingly benefit the wealthiest Australians. On average, each of these high-income individuals gained $271,000 […]

Adnate and Oxfam unveil powerful Fitzroy mural challenging extreme wealth and power

Celebrated street artist Matt Adnate, in collaboration with Oxfam Australia and Juddy Roller have today proudly unveiled a powerful new mural in Fitzroy that captures urgent global themes of wealth inequality, concentrated economic power and collective empowerment. The mural launch coincides with the World Economic Forum in Davos and as new Oxfam analysis revealing average […]

Average Australian billionaire wealth grew by over half a million dollars a day in the last year: Oxfam Australia

New report calls for taxing the super-rich to tackle rampant inequality Average Australian billionaires’ wealth grew by almost $600,000 a day in the last year alone, or over $10.5 billion collectively, new Oxfam analysis reveals today as the World Economic Forum opens in Davos. Since 2020, eight new Australian billionaires have been minted. Today, Australia’s […]

Tackle inequality. Make tax fair.

Together, we can create a fair and equal future without the inequalities that keep people in poverty. Tell the Treasurer to bill the billionaires and big corporations. Make them pay their fair share.

MAKE TAX FAIR